Understanding competitive advantages, potential market responses, and industry evolution ensures better investment decision-making. Project duration affects risk assessment, return expectations, and resource allocation decisions. Organizations must consider technological obsolescence, market changes, and maintenance requirements when determining appropriate project timeframes and investment horizons. Organizations must systematically evaluate potential market risks, including changes in customer preferences, competitive actions, and industry disruptions. This analysis helps develop appropriate risk mitigation strategies and ensures projects can withstand various market challenges.

Currency Exchange Rates

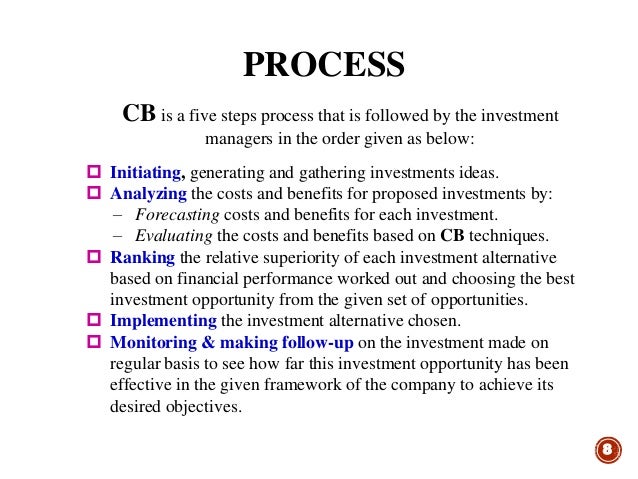

Building a new plant or taking a large stake in an outside venture are examples of initiatives that typically require capital budgeting before they are approved or rejected by management. Next, the organization’s capital budgeting committee must identify the expected sales shortly. After that, they recognize the investment opportunities keeping in mind the sales target set up by them. One must consider some points before searching for the best investment opportunities. It includes regularly monitoring the external environment to get an idea about new investment opportunities.

Scenario analysis evaluates multiple outcomes

Non-cash accounting deductions, such as depreciation, are not included in these calculations. In our example, the truck’s cost would be its initial purchase price plus taxes and registration fees. The operating costs will consist of drivers’ wages, fuel, maintenance and licenses. It’ll establish the feasibility of the project in technical, financial, market and operational ways. Deskera can also help with your inventory management, customer relationship management, HR, attendance and payroll management software.

Do you own a business?

Thus, it is a process of deciding whether or not to commit resources to a project whose benefit would be spread over the years. Capital budgeting is the planning of expenditure whose return will mature after a year or so. The NPV rule states that all projects with a positive net present value should be accepted while those that are negative should be rejected. If funds are limited and all positive NPV projects cannot be initiated, then those with the high discounted value should be accepted. Capital budgeting involves using several formulas to assess the profitability of a business opportunity or asset, such as when entering a new market or buying new machinery. Suppose, in our example, the trucking company owner decides to pay cash for the truck, which will cost a total of $75,000.

Apply appropriate discount rates

Throughput analysis through cost accounting can also be used for operational or noncapital budgeting. If a business owner chooses a long-term investment without undergoing capital budgeting, it could look careless in the eyes of shareholders. The capital budgeting analysis helps you understand a project’s potential risks and potential returns. A capital budget can also assist with securing additional financing from banks or investors when pursuing a new investment project.

- The profitability index (PI) is calculated by dividing the present value of future cash flows by the initial investment.

- Engage key department heads, operational managers, and front-line employees in the ideation process.

- The process analyzes factors like market research costs, marketing expenses, distribution requirements, and regulatory compliance while assessing potential returns and risks in new markets.

- Careful consideration of budget constraints and optimal resource allocation is crucial.

Estimate ongoing costs including maintenance, labor, utilities, raw materials, and overhead expenses. Factor in potential cost escalations, efficiency improvements, and operational synergies that might reporting 529 plan withdrawals on your federal tax return impact the project’s long-term financial performance and viability. Evaluate how well each proposed project aligns with the organization’s long-term vision, mission, and strategic objectives.

IRR serves as a crucial metric for comparing projects of different sizes and durations by calculating the rate that makes NPV zero. Establish systems for tracking relevant economic indicators and market trends affecting project viability. Implement robust data collection and verification systems to ensure accuracy and consistency. Organizations frequently face constraints in available capital, making it challenging to fund all worthwhile projects. Working capital needs must be estimated by analyzing inventory levels, accounts receivable, and payable requirements specific to the project. Establish effective communication channels and collaboration protocols between different departments involved in project implementation.

Opportunity costs are the benefits lost because of investment decisions and important to consider when capital budgeting. The time value of money is about the potential rate of return on the investment as well as the reduced purchasing power over time due to inflation. Project risk means one or multiple uncertain events that, if occur, can impact the basic objectives of the project. Companies must incorporate project risk in their capital budgeting process to make sure that their cash flow forecasting is not overly optimistic. For this purpose, they can apply various risk analysis techniques like sensitivity analysis, scenario analysis, risk adjusted discount rate and certainty equivalent cash flow etc. Just as important as managing the costs on budgeted capital projects, is monitoring the anticipated benefits.

As per this technique, the projects whose NPV is positive or above zero shall be selected. Here, full years until recovery is the payback that occurs when cumulative net cash flow is equal to zero. Cumulative net cash flow is the running total of cash flows at the end of each period. Keeping this in mind, a manager must choose a project that provides a rate of return that is more than the cost of financing a particular project, and they must therefore value a project in terms of cost and benefit. As a manager, it is important for you to understand the characteristics of capital budgeting and how these can affect your business. When venturing into the terrains of global business, capital budgeting presents a unique set of challenges and considerations that corporations must take into account.

It involves the planning and analysis of investment in long-term assets such as new or replacement machinery, new plants, products or R&D. The internal rate of return (or expected return on a project) is the discount rate that would result in a net present value of zero. Use this capital budgeting technique to find the discount rate that’ll bring a project’s net present value to zero. That is, the internal rate of return generates a yield percentage on a project instead of a dollar value. Capital projects that have a higher internal rate of return are usually the better investment. The purpose of capital budgeting is to make long-term investment decisions about whether particular projects will result in sustainable growth and provide the expected returns.