The Cash Account is increased by the selling price, $28 per share times the number of shares resold, 100, for a total debit to Cash of $2,800. The Treasury Stock account decreases by the cost of the 100 shares sold, 100 × $25 per share, for a total credit of $2,500, just as it did in the sale at cost. The difference is recorded as a credit of $300 to Additional Paid-in Capital from Treasury Stock. When a company purchases treasury stock, it is reflected on thebalance sheet in a contra equity account.

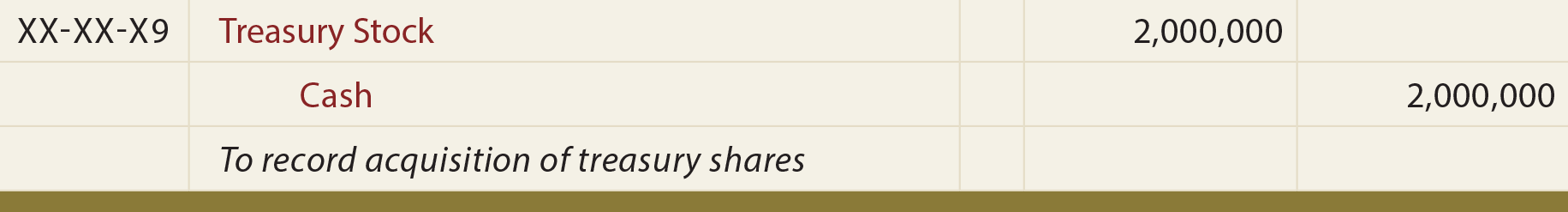

- The following journal entry is recorded forthe purchase of the treasury stock under the cost method.

- When a company has more than one class of stock, it usually keeps a separate additional paid-in capital account for each class.

- A reverse stock split occurs when a company attempts to increase the market price per share by reducing the number of shares of stock.

- Finally, as in the bid by Mars to acquire Wrigley, the investor may seek to obtain a controlling interest in the other company.

- A stock dividend distributes shares so that after the distribution, all stockholders have the exact same percentage of ownership that they held prior to the dividend.

Samsung Boasts a 50-to-1 Stock Split

Regardless of the type of dividend, the declaration always causes a decrease in the retained earnings account. Just after the issuance of both investments, the stockholders’equity account, Common Stock, reflects the total par value of theissued stock; in this case, $3,000 + $12,000, or a total of$15,000. The amounts received in excess of the par value areaccumulated in the Additional Paid-in Capital from Common Stockaccount in the amount of $5,000 + $160,000, or $165,000.

2 Analyze and Record Transactions for the Issuance and Repurchase of Stock

As a contra equity account, Treasury Stock has a debit balance, rather than the normal credit balances of other equity accounts. In substance, treasury stock implies that a company owns shares of itself. Treasury shares do not why you should get a cpa to prepare your taxes carry the basic common shareholder rights because they are not outstanding. Dividends are not paid on treasury shares, they provide no voting rights, and they do not receive a share of assets upon liquidation of the company.

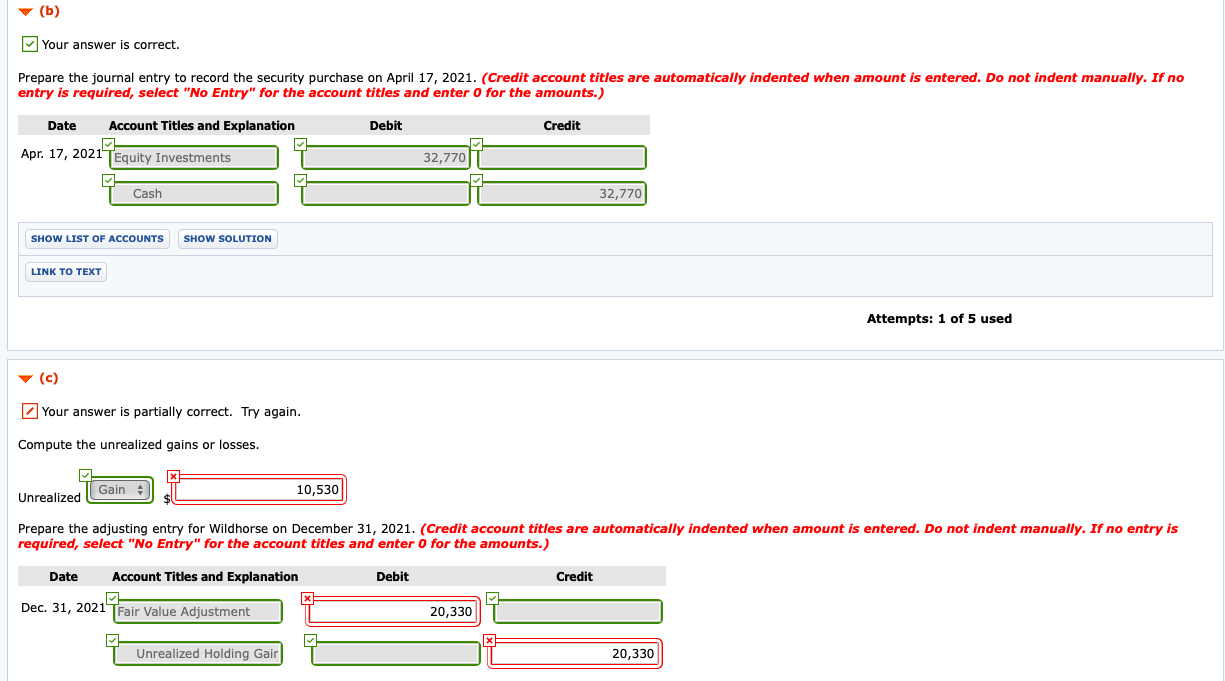

Journal Entry for Purchase of Stock Investment

Briefly indicate the accounting entries necessary to recognize the split in the company’s accounting records and the effect the split will have on the company’s balance sheet. The date of record determines which shareholders will receive the dividends. There is no journal entry recorded; the company creates a list of the stockholders that will receive dividends.

This will depend on how much ownership the company has in other companies. You are correct when you buy stock personally but, in this case, the OP purchased the business by acquiring 100% of the company’s stock. Similar to when you purchase a business in an asset sale and you record the assets purchased as assets on the balance sheet, the stock purchased in a stock sale sits on the books as assets. At the time dividends are declared, the board establishes a date of record and a date of payment. The date of record establishes who is entitled to receive a dividend; stockholders who own stock on the date of record are entitled to receive a dividend even if they sell it prior to the date of payment. Investors who purchase shares after the date of record but before the payment date are not entitled to receive dividends since they did not own the stock on the date of record.

As a contra equityaccount, Treasury Stock has a debit balance, rather than the normalcredit balances of other equity accounts. In substance, treasury stockimplies that a company owns shares of itself. Treasury shares do not carrythe basic common shareholder rights because they are notoutstanding. Dividends are not paid on treasury shares, theyprovide no voting rights, and they do not receive a share of assetsupon liquidation of the company.

There is no auditor’s report required when reserves are created under these provisions. Also, these distributable reserves provide flexibility to the remaining shareholders to draw dividend as well. Generally, the buyback out of distributable profits is a much simpler and easier route than a buyback out of capital due to the onerous nature of the requirements. But when a company does not have sufficient distributable profits out of which to finance the buyback, a purchase out of capital may appear to be the only option.

Reports like Trial Balance and Balance sheet work out Opening Balances, Retained Earnings, Net income for the year on the fly by summing appropriate journal records. The company usually records the purchase of the treasury stocks first before deciding whether to resell them or retire them later. When equity shares are bought solely as a way to store cash in a possibly lucrative spot, the investor has no interest in influencing or controlling the decisions of the other company. That is not the reason for the purchase; the ownership interest is much too small. The company can raise the capital by issuing equity or debt security to the capital market.